The Year That Was

By: Eric Lohmeier, CFA

The year that was 2023 feels eerily similar to the first days of 2024. Two plus feet of snow in the first few weeks, scrambling during school and event cancellations, and wait for it, looking through to February which hands us an extra day this year! However, hope springs eternal, and we are forecasting an early spring as it pertains to the capital markets and M&A environment.

The Year That Was:

2023 was the most challenging capital markets environment since the Great Recession. Notwithstanding an incredible second half of the year for the Magnificent Seven1 and AI hype, which catapulted the S&P 500 to another record, activity for private equity, venture capital and M&A volume trended to 10 year lows. Last year we predicted a “white-collar” recession, and 2023 did not fail to deliver.

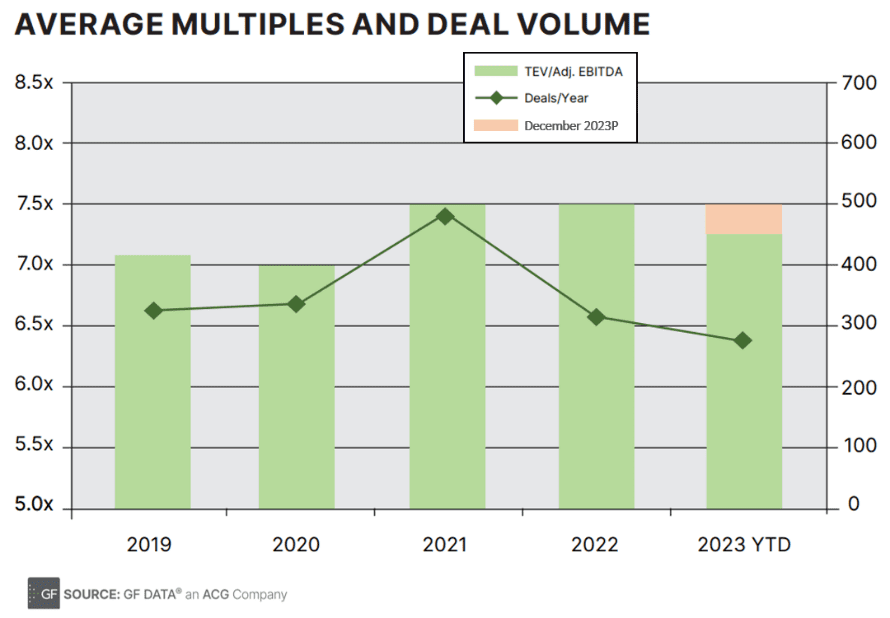

Counterintuitively, in our middle-market M&A sliver of the capital markets, “quality” deals – simply defined as year-over-year revenue growth >5% and sustained profit margins – ruled the roost. Coming off a laggard second-half in 2022, our industry’s strategy of hoping for green shoots and increased deal volume in 2023 reinforced the timeless axiom that “hope is not a strategy”. With high quality companies as the only game in town, that meant more competition for a fewer number of viable transactions. The upside of a market focused exclusively on sustained growth and healthy margins was that valuations continued to hold strong.

The above chart illustrates the material deficit in annual volume of deals and overall transaction value, but drives home the fact that for the right sectors (infrastructure, healthcare, A/I and other hot technology) the dollars available on private equity and investment grade company balance sheets capitulated to sellers’ rational valuation expectations. Middle-market valuations held at historic highs despite one of the highest rate environment in two generations.

Closing the loop on 2023, we believe that “Great Expectations” of materially decreased valuations held by acquisitive firms did not hold, even with tighter lending standards and higher cost of debt capital. The solution for acquirors was to to contribute a higher percentage of equity to a transaction versus prior years’ more aggressive use of leverage. This ultimately means that recent private equity ‘vintages’ of promising return profiles of 20%+ are more aspirational than they are realistic.

2024 Expectations and ‘Top Trends’ Commentary:

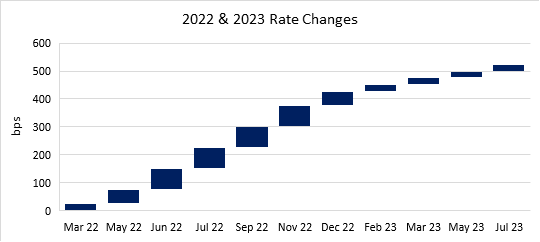

To any market observer, the last couple of years was a harrowing ride as it pertains to the two sources of middle-market M&A debt capital: 1) commercial bank lenders and 2) private debt capital (i.e. non-bank direct lending). The markets had quite an adjustment to the largest serving of increases to the Fed Funds rate in recent history between May ’22 and the last 25 basis point increase in June ’23.

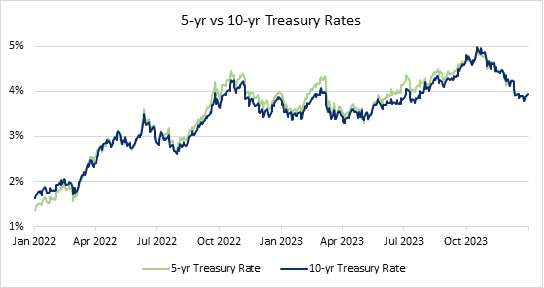

More pertinent to the Fed Funds increases from a 2023 perspective was the volatility in the 5- and 10-year Treasury rates:

The first handful of Fed Funds rate increases had muted effects on the longer end of the Treasury Curve, as evidenced by the 5’s and 10’s going no higher than a 3.x% handle until May ’23 – which corresponded with the “Big 3” bank failures and the Fed’s emergency Bank Term Funding Program. While the Fed was generally successful in mitigating the immediate short-term crisis aspect of commercial bank liquidity, the knock-on effects were felt keenly by the private lending markets, which were effectively shut down for most of the remaining months of 2023. Further chilling the activity freeze was liquidity in secondary markets for these assets dropping to effectively ‘zero’ and new issues almost non-existent. Even for the highest quality issuers, borrowing rates that were priced at 4 to 5% through 2022 shot up to north of 10%. From a practical standpoint, this left the traditional sources of commercial bank lending as the monopoly that it was in the past if a borrower did not have the size or scope to issue investment grade bonds directly through the capital markets.

The 5- and 10-year on-the-run Treasuries peaked at a rate of over 5% in early October, and combined with the daily volatility in these rates this had the effect of putting the entire M&A market in a deep freeze, as it was virtually impossible to lock down medium-term fixed-rate financing in support of transactions.

Fortunately, after tipping the 5% threshold, Treasuries participated in the furious market rally in the fourth quarter of 2023, and rates trended back to approximately 4%, a similar spot to where they stand today. In addition, the fourth quarter of 2023 saw significant tightening across the spectrum from investment grade to high-yield – private lending is clawing back and opportunistic fund raising by large private equity asset managers likely increases deal activity on the horizon.

The overall stabilization of interest rates supported a bump in transactional volume to close out 2023, and ultimately supports what we believe will be the first year of increased volume in overall M&A since 2021.

Takeaways:

“It’s gonna be alright” (Name the artist and song for a free coffee)

Sellers have held on valuation or simply delayed or pulled their deals from the market over the past two years. If we maintain a rate tenor around 4% on the 5- and 10-year Treasuries, this is very supportive for an improved M&A environment in 2024.

Quality still rules the day – we believe valuations in the middle-market will hold at historical top-quartile levels, but it will be driven by “quality” assets and likely to strongly favor strategic over purely financial buyers.

Strong credit profile companies – if you are having difficulty with your existing commercial lender (e.g. refinance, capital expenditure or acquisition financing, etc.) and you are not negotiating around 200 basis points over a 5-year Treasury reference rate it is time to get serious with a new lender. Commercial and Industrial loans are in high demand, especially with healthy community and regional banks as they need to work down their historical over-reliance on commercial real estate.

Venture capital, especially early to mid-stage companies that remain in a cash burn mode face another extraordinarily challenging year – the solution for these young companies will be capitulating to new money’s demands on down rounds and investors’ structural advantages (i.e. new investor dollars will land higher in the capital structure vs prior). The alternative for most is simply going out of business.

Insightful and thought-provoking!

Is the song by Gerry & The Pacemakers?